You must provide your local tax or social identification number for the form to be valid. Part I identifies the name, location and the beneficial owner, which for purposes of Forms W-8, is the owner of the account. If you are a student in the US who is not a US Citizen or green card holder on an F-1 Visa even though you are considered a US Resident.If one owner is a US Citizen, green card holder or legal resident you should complete a W-9. You are opening an individual or joint account and are not a US Citizen, green card holder or legal resident of the US For joint account owners: both owners must be non –US Citizens, green card holders or legal US residents to complete Form W-8BEN.Refer to information below for the specific type of W-8 you should complete and how long your Form W-8 is valid from the date signed.Ĭertificate of Foreign Status of Beneficial Owner for United States Tax Withholding, allows you to certify that you are a not a US person and claim treaty benefits under an existing tax treaty between the US and your country of tax residence, if applicable.

#W8 IMY INSTRUCTIONS HOW TO#

IBKR encourages its clients to consult with their tax advisors for further guidance on how to seek relief for any tax withheld. If you fail to provide a Form W-8, or do not resubmit a new W-8 when prompted upon the three-year expiration, additional withholding will apply. Note that if you complete Form W-8 you will not receive a Consolidated Form 1099, but you may receive Form 1042S.

Treaty rates, if applicable, will no longer apply. If the form W-8 is no longer valid, IBKR will assume that you are a non-US person and withhold US tax at 30% on interest, dividends, gross proceeds and payments and lieu. This form must be renewed every three years. Note: IBKR will send you an email when you are required to resubmit your Form W-8.įorm W-8, Certificate of Foreign Status, must be on file with IBKR.

#W8 IMY INSTRUCTIONS UPDATE#

Failure to update your W-8 form will result in withholding on all income including gross proceeds from securities sales. For example, a Form W-8BEN signed on March 5, 2018, remains valid through December 31, 2021, and must be resubmitted to IBKR no later than January 30, 2022. US Tax withholding on distributions from Publicly Traded Partnerships is withheld at 37% (2018) as this is earned income in the USįorms W-8 are valid for the year in which they are signed and for the next three calendar years.

The rate of withholding may be reduced if there is a tax treaty between your country of tax residence and the US Generally, tax is withheld at a rate of 30% on payments of US source stock dividends and substitute payments in lieu. W-8 Forms are not provided to the IRS.įorms W-8 are valid for the year in which they are signed and for the next three calendar years.

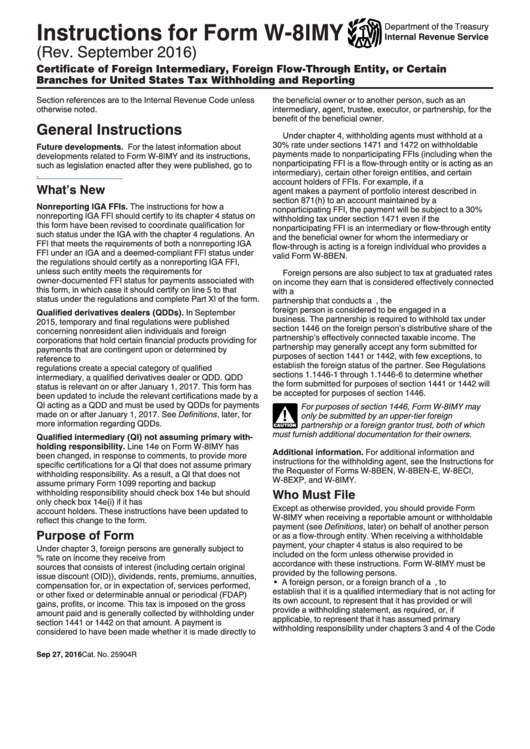

The type of W-8 form completed depends on the whether or not you open an individual account or an entity account. All non-US persons and entities are required to complete an IRS Form W-8 to certify your country of tax residence and to establish whether you qualify for a reduced rate of withholding when opening an account.

0 kommentar(er)

0 kommentar(er)